Is Homeownership Within Reach in Canada? The Housing Affordability Index Can Tell You

The housing affordability index is a useful tool for anyone who has questions about home prices and housing affordability. Here’s how it works, what it does, and what it means for you.

What is the housing affordability index?

The housing affordability index is the measurement of how affordable housing is in Canada. It compares the amount of disposable income that an average Canadian household must put toward housing-related costs (including monthly mortgage payments and utility fees) with the average Canadian household’s disposable income.

That looks like a lot, but if you break it down, it starts to make sense.

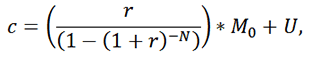

In this equation, c is overall quarterly housing costs, r is the effective mortgage rate, N is the number of monthly payments, M0 is the total value of the mortgage, and U is the cost of utilities.

Let’s start with r, the effective mortgage rate. To get a single rate that includes most mortgage options in Canada, the BoC uses “a weighted average of discounted 1-, 3- and 5-year fixed-rate mortgages and the discounted variable-rate mortgage” (Bank of Canada).

Next, will fill in N, which is the number of monthly payments. The BoC assumes this to be 300—or 12 monthly payments each year over the course of 25 years.

M0 is the total value of the mortgage, which the BoC assumes is 95% of the home’s value (and remember, the equation uses a national average home value).

Finally, we fill in U, which is the cost of utilities based on the consumer price index for water, fuel, and electricity (Bank of Canada).

Once you work out this equation, you divide it by the average household disposable income in Canada. Where do you get that information? The Bank of Canada uses “total quarterly household disposable income from the National Income and Expenditure Accounts” (Bank of Canada) and then divides it by the number of households in Canada (based on census data).

Brain spinning?

Don’t worry. It’s a lot of information! Instead of trying to do the math yourself, you can check out an interactive graph on the Bank of Canada website showing the housing affordability index and the new home price index.

What’s important to understand about the housing affordability index is that it compares the amount of income most Canadians can spend and the amount they have to spend to afford housing.

The main problem for many right now is that housing affordability is low.

Housing affordability in Canada hit an all-time low last year.

In May, a report from Desjardins showed that housing affordability reached an all-time low in 2022, demonstrating “historically stretched affordability” for Canadians. It also stated that there’s no expectation for “significant improvement in affordability in the next couple of years” (Nojoud Al Mallees, CBC News).

There are several contributing factors to historically high costs and low housing affordability, but two major ones are low inventory and high mortgage rates.

The federal housing agency reported that there would need to be 3.5 million additional homes built by 2030 to make housing affordable again—and that’s on top of the current building pace. The problem is that the country is not on track to hit this goal, and if it doesn’t, the housing shortage will continue to push prices higher.

Additionally, the cost of financing a home has increased rapidly over the last two years, and hopes for a major drop in interest rates don’t look promising. As the Bank of Canada fights to push inflation downward, mortgage rates will likely stay elevated in the near future.

With all this information, you’re probably wondering: is there any good news?

Wages outstripped inflation for the first time in March

In March of this year, the Financial Post reported that wage growth had finally surpassed inflation for the first time in two years. In June, another piece from Global News confirmed that wages continue to outpace inflation for most Canadians. This paired with new reports that inflation is coming down means that your purchasing power is starting to grow—so if you have your sights set on purchasing a home, don’t give up.

Wondering if you can afford a home in our market?

Get in touch. National numbers are a great measuring stick to see how the overall economy and housing market are doing, but they don’t account for local home values and your personal financial situation.